What if my old taxation statements you should never let you know an excellent earnings?

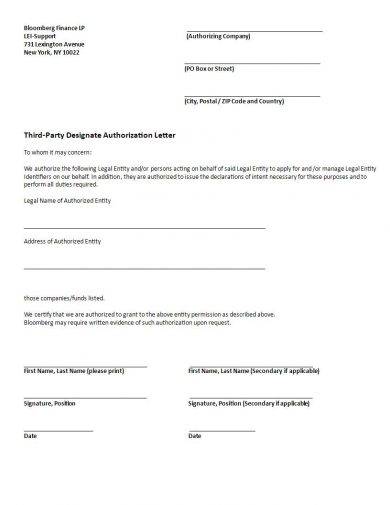

- Financial Documents

- Tax returns

Self-operating conditions

- Last one or two years’ monetary comments (money & losses and harmony layer)

- Past one or two years’ team taxation statements

- Last a couple years’ individual taxation statements

- Past a couple of years’ notices away from investigations

- Last a couple years’ faith tax statements (when the borrowing by way of a believe)

As an option to NoA, a primary financial towards all of our panel encourage a page out of your accountant guaranteeing your very own tax return was finally and you will lodged on ATO.

Is actually write tax returns acceptable?

Typically, the lending company have a tendency to glance at to ensure this new tax returns try closed and official and you may supported from the notices regarding investigations. That is a simple scam glance at so such would be the taxation statements you lodged to your Australian Taxation Office.

Write tax returns are only accepted because of the the the loan providers if for example the accountant can produce a letter verifying they are the finally content and that’s lodged toward ATO.

You will find a long list of just how banks will evaluate your taxation statements to the the notice-operating financial page. Rather, build an on-line inquiry or e mail us for the 1300 889 743

Ages of taxation statements

That is where banking institutions extremely tell you an enormous difference in the way they read your own tax statements! By February or April every year extremely lenders begin to query having taxation statements for the most recently accomplished monetary year. Until the period you might deliver the tax statements from the season before!

Very, instance, if you applied for the majority loan providers would need your own tax statements having 2011 and you will 2012 but in productivity.

One of our loan loan places Walden providers is only going to require that you offer one to year’s tax returns (no over the age of 18 months) that is ideal for people who could have had a detrimental 12 months the entire year ahead of otherwise which only has just already been their business.

- Past year’s economic statements (money & loss and you can balance layer)

- History year’s providers taxation statements

I’ve unique preparations with many in our lenders that enable individuals to provide it option papers to possess 90% fund and you may, for one lender, financing around 95% of the home purchase price.

Older tax returns

Old tax statements is going to be accepted because of the the our loan providers that is great for folks who have a beneficial a good earnings but i have not even complete their newest tax return.

Can we cut-down new papers?

For those who have numerous organizations otherwise an elaborate finances, then you may discover that we require numerous data.

Just give us the accountant’s details and we will provide them with a visit to inquire of to possess smooth duplicates of each document. By doing this it’s not necessary to worry about checking or photocopying.

What unexpected situations would banking companies get in tax returns?

Banks aren’t just considering your revenue! It often pick one thing from inside the man’s taxation statements one to produce the mortgage are refused:

The mortgage brokers often read the tax returns completely ahead of giving these to the lending company to ensure that all the details on the application fits all the information on your own tax statements.

SMSF funds

To possess notice-managed superannuation financing (SMSF) funds, very financial institutions requires the past two years’ tax statements regarding your own have confidence in acquisition effectively assess its most recent money.

In case the faith is new following we can fool around with different ways to show the money because of the and in case a specific return to the total value of the fund’s property.

The lending company desires to ensure that the fresh trust’s money also brand new proposed leasing earnings could be adequate enough to service the brand new obligations.

Our SMSF loan webpage is also will bring more information on exactly how borrowing from the bank within this a count on functions and you can what the gurus is actually.

Need assistance trying to get an enthusiastic SMSF financing? Contact us into 1300 889 743 otherwise ask online and you to definitely your mortgage brokers can get you already been on your own app.