We authored a consultative document for the , to find viewpoints to the mortgage financing dangers, particularly obligations serviceability

The office of your Superintendent out-of Financial institutions (OSFI) could be using financing-to-earnings (LTI) restriction into the profiles regarding federally controlled creditors for brand new uninsured mortgages.

The fresh LTI limit is a simple supervisory level which can maximum highest degrees of family personal debt round the per Alaska title and loan institution’s uninsured home loan financing portfolio.

- It will act as a backstop into the Minimal Being qualified Price (MQR), instance during the periods regarding low interest.

- It will not apply at personal consumers.

- It will help you advance the mandate away from protecting the new legal rights and you will appeal out-of depositors, policyholders and you can financial institution creditors.

What we should heard

We noted that people value LTI and you will Debt-to-money (DTI) just like the smoother measures that’ll maximum highest levels of family loans in the a collection top. This mitigates financial obligation serviceability risks of the more really addressing the underlying susceptability.

OSFI also referred to as out this matter in semi-annual inform so you’re able to their Yearly Risk Mind-set. When it comes to those products, we seen you to definitely other Canadian loan providers features various other risk appetites that have novel organization activities from inside the a highly aggressive mortgage industry. Therefore, an easy, macroprudential LTI measure might not be match-for-mission inside Canada.

Results

Based on the session viewpoints, OSFI changed their way of obligations serviceability. The audience is moving of a consistent, policy-built LTI restrict that will be practical across the globe, to help you a more nuanced and you can tailormade strategy at the a single FRFI-height. Consequently our advice altered off good macroprudential to a beneficial microprudential implementation.

Objective

Higher household obligations is still strongly related credit risk, the safety and you may soundness away from FRFIs, plus the full balances of one’s financial system. High LTI loans started inside low-value interest schedules are creating an extended-name vulnerability with the Canadian financial system. OSFI’s LTI construction can assist prevent an identical accumulation away from finance to your courses given to very leveraged and indebted borrowers in the future.

While both obligations service ratio limitations while the MQR seek to address loans serviceability, the latest size will act as a backstop and gives a great convenient precautionary size. It design tend to parallel the brand new way of financial support from the Basel III framework.

The brand new LTI maximum build was created to ensure it is establishments to steadfastly keep up its same cousin aggressive positions in the market. Put simply, OSFI’s LTI maximum construction was proportionate with the different organization habits fighting getting Canadians’ mortgages.

Recommended build design

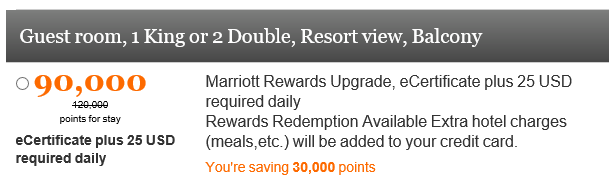

This new measure could well be relevant for new originations at the collection top, maybe not having private individuals. To your good every quarter base, per business will have to gauge the part of the newly originated financing you to surpass brand new 4.5x mortgage so you’re able to money multiple.

While which cuatro.5x numerous could be prominent round the most of the organizations, this new portion of the the fresh new bookings and that’s allowed to go beyond it numerous was book to each and every facilities and its particular bespoke competitive model.

Limitations

Restrictions will be derived playing with a regular and principle-mainly based method. Particularly, the historical past regarding high LTI originations styles is analyzed from the private establishment level. The latest framework considers both the period of low interest, plus the newer origination trend in large interest ecosystem.

Scope away from money

To end the fresh new accumulation away from influence of the cracking funds on the quicker components at some other establishments, all fund safeguarded contrary to the subject assets are needed to-be for the range:

- very first and second mortgage loans, HELOCs, or other borrowing from the bank auto;

- men and women stored from the exact same otherwise an alternative place;

- regardless of the intended use of the assets (owner-occupied otherwise money spent for rental).

Being qualified income

Total qualifying income according to research by the institution’s definition might be applied. This would make to the reason always assess loans provider percentages.

Rationale

OSFI even offers presented quantitative acting practise to evaluate more prospective structures on the development of the limits. However, despite a life threatening upsurge in difficulty of the steps, this new resulting limitations had been in the-range with this particular simplistic means.

Execution

New LTI measure is anticipated when planning on taking impact by for every institution’s particular fiscal Q1, 2025. Once used, OSFI usually predict every quarter compliance revealing.