Home loan In the place of Tax statements Needed Alternatives for 2024

Is it possible you Rating a mortgage in the place of Delivering Tax returns?

Many people battle being qualified for a mortgage unless they supply the quality income documents for the last a couple of years. not, discover financial alternatives for those who don’t provide tax statements or if perhaps your own tax returns do not reveal sufficient earnings in order to qualify for home financing.

Lenders which give mortgages instead providing tax returns usually structure this type of financing applications to possess notice-employed homebuyers. Most of the time, he’s plenty of team deductions reducing its net income to the stage where in actuality the tax returns tell you hardly any income otherwise a loss of profits.

Lenders whom offer mortgages with no income tax go back requirement just remember that , the new documented earnings on your tax returns is not as essential since the amount of cash your launching per few days. This means that, he or she Alabama loans is alternatively inquiring observe twelve-couple of years bank comments. It is a great way to finance your perfect household in the place of having to render tax returns.

Call us to review your options or to get a thought exacltly what the rate could be. When you can simply quickly finish the setting lower than, on the right or in the bottom of your display in the event the you are looking over this into a mobile device. A qualified mortgage officer will act quickly.

Do you score home financing as opposed to delivering taxation statements?

You’ll find loan providers that have loan programs for those who don’t offer taxation statements. He or she is designed for one-man shop consumers that not recorded taxation statements otherwise tell you an extremely lower net gain.

Conditions for Home loan Instead of Taxation statements

Borrowers are usually notice-operating The brand new zero taxation come back bank should be sure which sometimes which have a corporate checklist or a business licenses, a letter from the accountant, this site, etc. They may need a minumum of one of those to prove that you’re in business. 1099 individuals may also meet the requirements.

Down-payment Some no tax come back mortgage brokers can get inquire about a good ten% down payment, but it it depends on your unique situation. More often than not, this new advance payment are higher. Additional factors usually impact your own down-payment such as for instance credit rating, possessions, and much more.

Credit scores There are not any particular credit rating requirements, your credit history will play a major character in what your own down-payment and interest rate will be. Why don’t we enable you to contour this out versus needing to work with your credit.

No Income tax Return Conditions Most of all of our lenders will ask for your own last several-24 months’ bank comments. The bank statements could be put due to the fact money confirmation. They’re going to use the mediocre month-to-month dumps and can dump all of them due to the fact earnings. They typically have fun with 100% of deposits out of your personal bank accounts and you can a portion of your providers membership.

Almost every other Property It is important to listing as many assets you could so you can assistance with brand new acceptance of your financial application. Underwriters constantly glance at compensating factors and you can property is the most all of them.

FHA Finance without Taxation statements

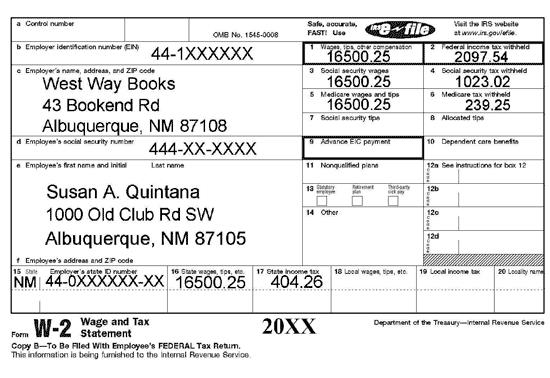

When you’re an effective W2 wage earner, you may be in a position to be eligible for a keen FHA financing in place of being required to likewise have the tax statements . Their FHA bank requires on exactly how to provide your W2’s over the past two years and additionally your recent spend stubs and you will lender statements.

This new degree process could be the exact same despite not having taxation productivity utilized in the loan application. Discover [ FHA Financing ]

No-Taxation Get back Financial Costs

One of the first concerns some body query whenever speaking-to a good financial is exactly what could be the rates. We simply said that not all of the loan providers give home loan software one do not require tax returns. There was exposure inside for the bank when the borrower dont offer all the fundamental and you can traditional documents.