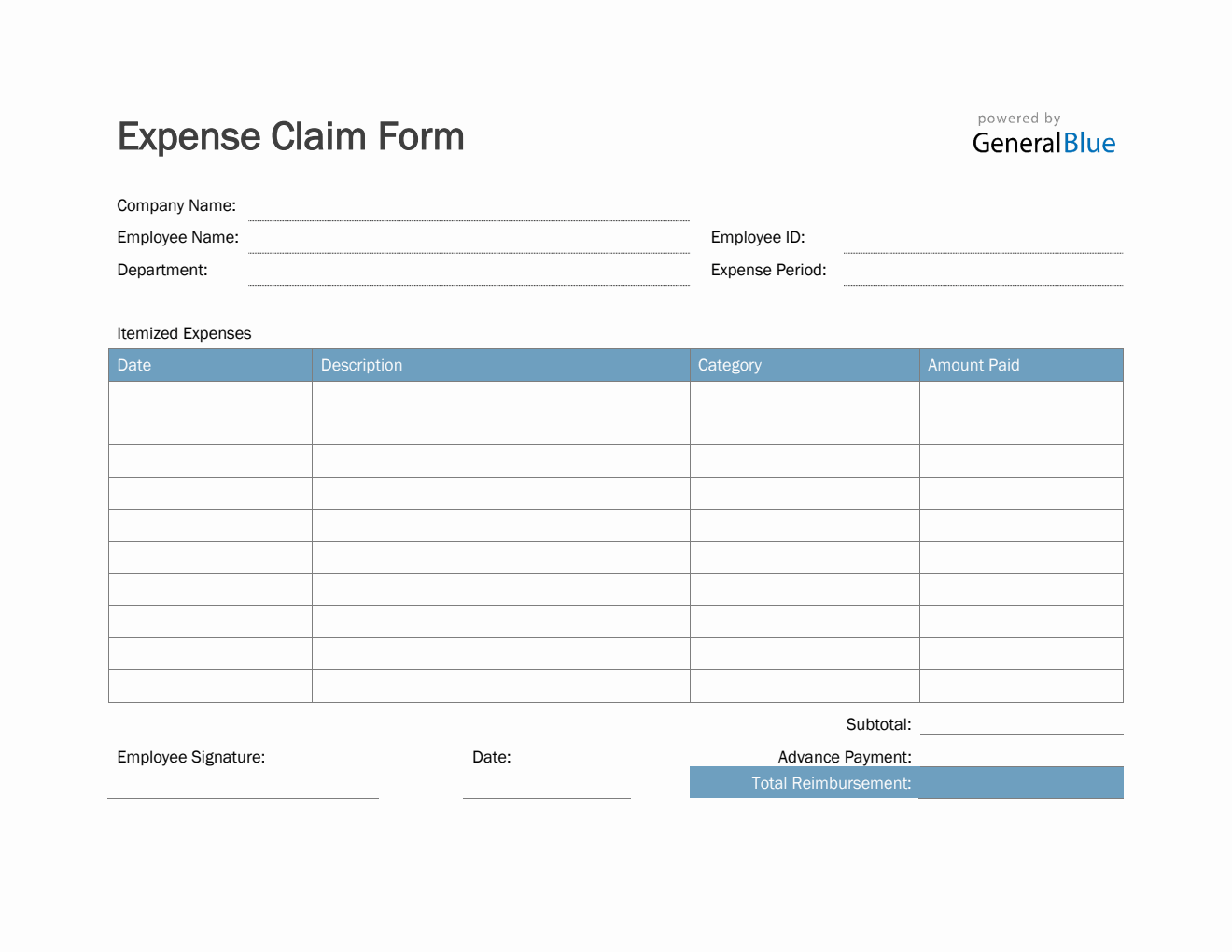

Can be an application used on financing closing to itemize the latest costs associated with purchasing the home

Household Collateral Credit line: A loan getting a borrower it is able to borrow money during the time plus the amount the fresh new borrower decides, as much as a maximum credit limit for which a debtor keeps licensed. Fees was secured of the collateral regarding the borrower’s family. Effortless notice (interest-only) costs into a great equilibrium) is normally taxation-allowable. Tend to useful for home improvements, significant orders or expenditures, and you may debt consolidation.

House Equity Mortgage: A fixed or varying price mortgage received many different intentions, shielded because of the collateral in your home. Notice reduced might be taxation-deductible. Usually useful do it yourself and/or releasing out-of security having funding various other a house or any other opportunities. Recommended by many to exchange otherwise option to individual fund whose focus is not income tax-deductible, such as vehicles or vessel funds, credit card debt, scientific loans, and you can academic loans.

HUD: The newest Institution out of Homes and you will Metropolitan Invention try founded from the Congress inside the 1965 and is accountable for the newest implementation and administration out of authorities casing and you will metropolitan invention programs. Such apps were people believed and creativity, property design and you will home loan insurance (FHA), additional home loan markets factors (GNMA) and you can equal options when you look at the casing.

Within this could be the settlement charges towards borrower, the amount of the mortgage to get paid, the latest terrible matter owed from the borrower, the primary amount of the brand new mortgage, and any other dumps or charge

HUD-step 1 Payment Report: That it document is established in the romantic away from escrow and facts all can cost you and costs that have been obtained or paid back when you look at the financing. Continua a leggere