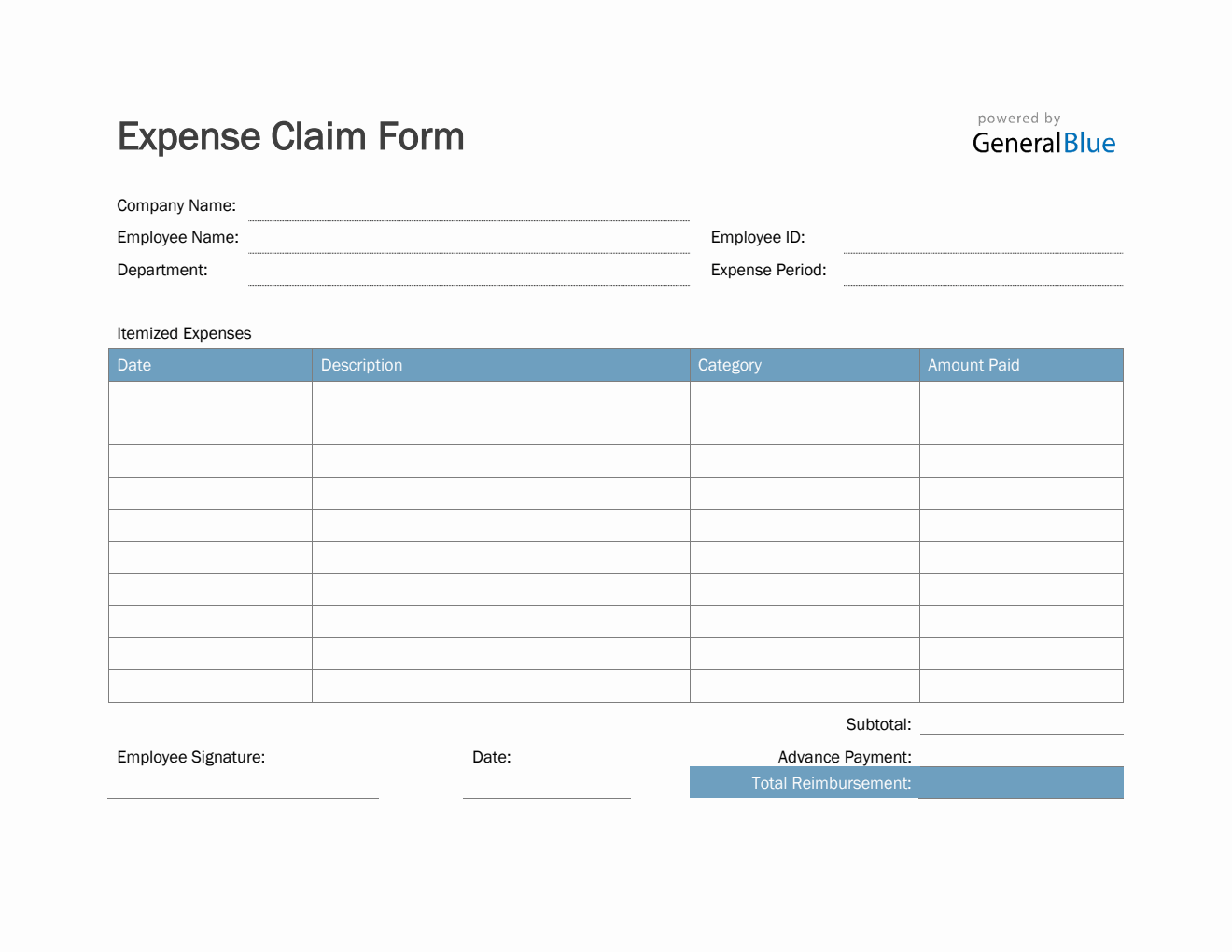

Can be an application used on financing closing to itemize the latest costs associated with purchasing the home

Household Collateral Credit line: A loan getting a borrower it is able to borrow money during the time plus the amount the fresh new borrower decides, as much as a maximum credit limit for which a debtor keeps licensed. Fees was secured of the collateral regarding the borrower’s family. Effortless notice (interest-only) costs into a great equilibrium) is normally taxation-allowable. Tend to useful for home improvements, significant orders or expenditures, and you may debt consolidation.

House Equity Mortgage: A fixed or varying price mortgage received many different intentions, shielded because of the collateral in your home. Notice reduced might be taxation-deductible. Usually useful do it yourself and/or releasing out-of security having funding various other a house or any other opportunities. Recommended by many to exchange otherwise option to individual fund whose focus is not income tax-deductible, such as vehicles or vessel funds, credit card debt, scientific loans, and you can academic loans.

HUD: The newest Institution out of Homes and you will Metropolitan Invention try founded from the Congress inside the 1965 and is accountable for the newest implementation and administration out of authorities casing and you will metropolitan invention programs. Such apps were people believed and creativity, property design and you will home loan insurance (FHA), additional home loan markets factors (GNMA) and you can equal options when you look at the casing.

Within this could be the settlement charges towards borrower, the amount of the mortgage to get paid, the latest terrible matter owed from the borrower, the primary amount of the brand new mortgage, and any other dumps or charge

HUD-step 1 Payment Report: That it document is established in the romantic away from escrow and facts all can cost you and costs that have been obtained or paid back when you look at the financing. Made use of universally by the mandate regarding HUD, brand new Agency out of Houses and you will Metropolitan Innovation.

HUD-step 1, Addendum: This is an additional webpage which may be connected, and verifies the consumers provides see and you may comprehend the HUD-step 1.

Rate of interest: The fresh periodic costs conveyed just like the a portion, for use of credit. Or perhaps the part of a sum of cash billed for its have fun with.

Index: A number, always a portion, upon which upcoming rates of interest to have varying price mortgages is basedmon spiders are Cost of Money into the Eleventh Federal Section out-of financial institutions or the average rate of 1-season Bodies Treasury Cover.

Credit line: An agreement in which a lending institution promises to lend as much as a certain amount without having to file an alternative software.

Financing so you can Well worth Proportion (LTV): A ratio influenced by dividing product sales rate otherwise appraised value to your amount borrowed, conveyed because a percentage. For example, having a revenue price of $100,000 and you will a mortgage loan regarding $80,000, a borrower mortgage to really worth ratio might be 80%. Fund having an enthusiastic LTV more 80% may require Private Home loan Insurance coverage (discover Private Financial Insurance rates).

Secure (otherwise Protected): A relationship a debtor receives out of a loan provider to make sure the debtor that a particular interest rate or function try locked in for one particular period of time. Will bring coverage is interest rates rise amongst the time the debtor applies for a loan, and obtain financing approval, and you may, subsequently, intimate the mortgage and you can get the funds the latest debtor has borrowed.

Impound Membership: A free account handled because of the organization lenders where in actuality the borrower will pay their houses fees and hazard insurance costs into the financial in monthly premiums along with the dominating and interest

Lowest Payment: The minimum number you to a debtor need to pay, usually monthly, towards the a property security financing or personal line of credit. In certain arrangements, minimal commission could be “focus payday loan Maplesville only,” (effortless attention). Various other preparations, minimal payment ortized).

Payment per month: The mortgage number, known as Dominating, what amount of Repayments, as well as the Yearly Interest rate (Mention Price) can be used to each other to determine the payment. This is actually the amount revealed to your Note. Whether your mortgage is completely amortized, as most financing was, next by making new payment every month timely, the whole prominent is reduced by the time the brand new last fee is due.