AvaTrade Review: Is it the Best Overall Broker?

Once you have done this, you can begin using the platform to make actual trades or practice with a demo account. Investors seeking a wide variety of forex, CFD, and cryptocurrency offerings may find what they are looking for with Avatrade. See how they compare against other online brokers we reviewed. AvaTrade offers customers access to third-party platforms for copy and social trading with AvaSocial, ZuluTrade, DupliTrade, and MQL5 Signal service. On the downside, Avatrade, despite providing cryptocurrency trading, does not accept or provide funds in cryptocurrencies. This could be a disadvantage for traders, who quite frequently use cryptocurrencies as a means of payment.

I like how they make everything available through one account. AvaTrade suggests higher spreads and several cryptocurrencies to choose from. Users can trade directly through the web trading platform and no electronic wallets is needed. AvaTrade Reviews mention that there are no hidden fees, zero commissions, financing rates, and no trading costs or bank account & bank transfer fees on the transactions executed. Fees are reasonably competitive for depositors, especially those trading individual stocks.

Make sure to read the AvaTrade Reviews till the end before registering with the broker. AvaTrade offers traders a broad range of trading platforms, including a dedicated options trading platform and its proprietary mobile app and social trading platform. The available assets present a balanced mix, offering clients in-depth cross-asset diversification from a commission-free pricing environment. AvaTrade has withdrawal options and deposit options free of charge, low trading fees, and a free demo account.

Account opening is pretty straightforward, and as per marketing materials, AvaTrade has several deposit and different withdrawal methods, which are free of charge. Also Avatrade provide user-friendly search functions, educational tools, and daily market analysis research instruments. Avatrade does not charge commission or money when trading CFDs, forex, or even cryptocurrencies. The trading fees you will experience are bid-ask spread, and if you keep the position open past standard dealing hours, you will incur overnight financing fees. AvaTrade also includes a wide range of complex instruments with new traders to open accounts, and the broker includes dedicated research and educational options that help them up significantly. In addition to this, AvaTrade offers excellent balance protection allowing the customers to take insurance on the trade.

Customer support

71% of retail traders CFD accounts lose money when trading with this provider. You should consider whether you understand how CFD works and whether you can afford to take the high possibility of losing your money. The list of forex, CFD and options trading instruments https://broker-review.org/ is on par with industry standards with the addition of cryptocurrencies providing new opportunities for high-risk speculators. CFDs include a basic selection of commodities and bonds while shares and ETF offerings are dominated by highly liquid US big tech stocks.

Select jurisdictions also maintain an investor compensation fund. Our team of industry experts conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels.Click here to read our full methodology. A large Australian operation is regulated through the Australian Securities and Investment Commission . The broker also advertises negative balance protection and AvaProtect, but it provides no additional guarantees for safety of client funds.

- AvaTrade minimum deposit amount is very small, and individuals can start trading immediately.

- Via the powerful WebTrader platform, users can stay on top of the market without allocating too much time on technical or fundamental analysis.

- Everyone who sells or buys equity, debt, or any other investment with the help of a bank, real estate agent, broker, and many more.

- In addition, every broker we surveyed was required to fill out a 320-point survey about all aspects of their platform that we used in our testing.

- The reports section is good, similar to the web-based version.

While debit or credit card deposits are instant, traders have reported that, in some cases, it takes a few hours for the money to show up in the account’s available balance. Both the proprietary and third-party platforms supported by AvaTrade – MetaTrader 4 and 5 – are excellent, and their features are attractive. AvaTrade shines when it comes to education and displays care for beginner traders. While the official website featured content, the primary service is available at SharpTrader.

Moreover, traders can also manually close these positions anytime before any orders like limit orders or others are triggered. This helps AvaTrade to streamline the process by offering traders flexibility and convenience. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.

The BVI provides licenses to companies who are operating in financial services within this territory. They are regulated in an impressive 6 jurisdictions including Europe, Australia and South Africa, with regulatory licenses spanning 5 continents. Client funds are held in segregated accounts away from AvaTrade business funds for added security. AvaTrade produces daily in-house research content in video and article format, and grants access to Trading Central research modules. While AvaTrade has made improvements in this category, its research offering can’t stack up against what the best forex brokers offer.

A trader can copy signals or mirror complete strategies, thus enjoying the experience and knowledge of other traders. The different auto trading platforms provided by AvaTrade can help those with limited time or trading knowledge to engage in trading. Just be aware that if you do copy signals from other traders, there can be no guarantees on how well they will perform.

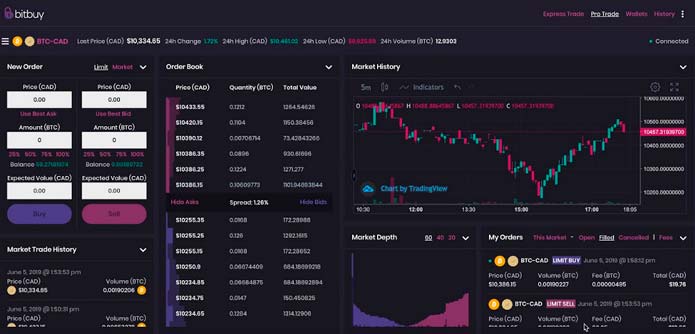

Platforms

AvaTrade offering several practical resources and trading tools. Most traders can benefit from a wide variety of trading platform options that Avatrade offers several ways to trade. AvaTrade has third-party platforms like MT4, MT5, and their own AvaTradeGO and Webtrader as well.

For trading ideas, AvaTrade offers a section known as ‘Analysts View’ or ‘Forex Featured Ideas’. Traders can find hints into potential trading signals spotted by other traders for most of the financial assets covered by the platform. No commissions are charged on AvaTrade accounts, but there are commissions payable on CFD trades. The platform makes money by charging a small markup on each currency spread. When you are ready to start trading, deposit £100 in your trading account.

On the other hand, experienced traders can save time by getting a clear view of the market, without having to perform daily research. Via the powerful WebTrader platform, users can stay on top of the market without allocating too much time on technical or fundamental analysis. It is quick and easy to buy and sell assets, whilst you can get accurate data on what AvaTrade’s traders are buying or selling in real time.

Mobile

When added up, these inactivity-related fees are quite high compared with AvaTrade’s peers. AvaTrade forex fees are not the best on the market,they are ratheraverage. The fee structure is very transparent and trading costs are easy to calculate.

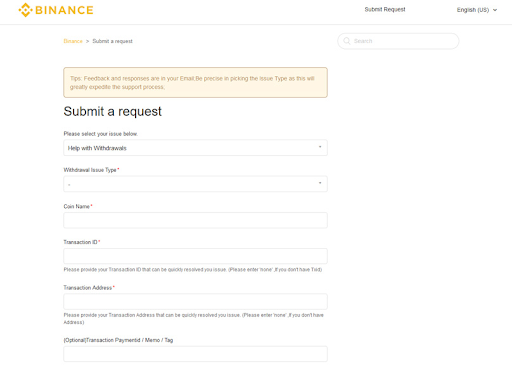

Avatrade offers very low spreads and have reliable order execution. User reviews show that AvaTrade has a quick registration process, low trading fees, competitive spread, and a minimum amount deposit requirements is 100 dollars for an e-wallet, credit, or debit card. Deposits at AvaTrade can be made through wire transfers, credit cards, debit cards. Withdrawals are processed immediately if the user submits a withdrawal form with any AvaTrade withdrawal option & there are no AvaTrade withdrawal fees, but it might take a few days for processing. Retail traders are non-professional or individual investors who sell or buy security with the help of saving accounts or brokerage firms such as 401ks. Everyone who sells or buys equity, debt, or any other investment with the help of a bank, real estate agent, broker, and many more.

We are rated among the highest in the industry and we remain a frontrunner. People who write reviews have ownership to edit or delete them at any time, and they’ll be displayed as long as an account is active. This is great to read, and we are pleased you have enjoyed the service from our team; we will be sure to pass your regards to Alev from the AvaTrade Team.

What is AvaTrade?

In Forex Options, for trading options, AvaTrade has its own desktop trading platform. AvaOptions with Vanilla Options helps clients in options trading to create a portfolio, choose from over 40 currency pairs, and reward. It also has portfolio simulations and professional risk management tools. MetaTrader platforms arethird-party trading software that is very popular among traders.

The sharp trader feature provides limited research, earning, and economic calendars. A 2-4 minute brief video on youtube comprises the spirit of research products and the script, and then it is transcribed as a daily market review. Trading central gives short-term technical and intra-day updates signals while blogs keep the clients updated on the market events. PublicFinanceInternational.org helps traders and investors, from around the world, navigate the complex world of online brokers. We spend thousands of hours a year, both researching and testing brokers, to give you unbiased and extensive reviews.

News feed

Avaprotect is a hedge/insurance that is available on the avatrade platform, you can insure your trade for a period of time, the longer you want to insure for, the more expensive it is. If you incur any losses in that time then Avaprotect will refund you. AvaTrade charges an inactivity fee which is $50 per quarter after 3 consecutive inactive months. Additionally after 12 straight months of inactivity there is an annual fee of $100. These inactive fees are quite high when compared to their competitors.

AvaTrade offers several free options for deposit and withdrawal. If you are an experienced trader, you can request AvaTrade to open a Professional Trading account for you, where the leverage is higher than in the Standard account. This requires that you have relevant experience in the financial sector and sufficient trading activity in the past 12 months, and hold at least €500,000 portfolio value.