What’s the jumbo financing limitation to possess 2024?

Jumbo finance

The easiest way to get home financing above old-fashioned financing limits is to apply a beneficial jumbo loan. A good jumbo financial is actually any home loan one exceeds local compliant restrictions.

Can you imagine a house client during the Boulder, CO puts off $100,000 towards the a good $1 million house. In this situation, its loan amount might possibly be $900,000. That is over the regional compliant mortgage restrict from $856,750. Which customer may need to loans their property pick having an effective jumbo mortgage.

You would imagine jumbo mortgage loans would have higher interest rates, but that is not necessarily the fact. Jumbo financing pricing usually are near if you don’t lower than antique mortgage cost.

The new connect? It is more difficult to help you be eligible for jumbo capital. You’ll likely you want a credit score over 700 and you may a lower fee of at least ten-20%.

For people who set-out lower than 20% on a good jumbo household buy, you will need to pay to own individual home loan insurance coverage (PMI). This would raise your monthly premiums and total financing prices.

Piggyback investment getting high-listed house

Even the very costs-active experience to decide an excellent piggyback financing. This new piggyback or loan is a type of financing in which a primary and you may next financial was opened meanwhile.

A buyer will get an enthusiastic 80% first-mortgage, 10% next mortgage (normally a home equity personal line of credit), and set 10% off. Here’s how it would performs.

- Home speed: $900,000

- Deposit: $90,000 (10%)

- Financial support necessary: $810,000

- Local conforming restrict: $726,2 hundred

- Advance payment: $ninety,000

- 1st home loan: $726,two hundred

- second mortgage: $83,000

The home is bought with more substantial conforming loan and good quicker next mortgage. The initial mortgage will come having most readily useful terms and conditions than simply a good jumbo financing, together with second mortgage even offers good rate, too.

Given that jumbo mortgage loans are above the conforming mortgage restriction, they truly are felt non-conforming and they are maybe not qualified to receive loan providers to market to help you Fannie mae otherwise Freddie Mac abreast of closure.

That implies lenders offering jumbo financing was able to place their particular requirements – together with loan limitations. Like, you to bank you are going to set their jumbo mortgage maximum from the $2 mil, when you find yourself a new you are going to put no restrict anyway and become willing to finance homes worth tens out of millions.

You need sufficient money to help make the month-to-month mortgage repayments to your your home. Plus debt-to-money ratio (as well as your coming mortgage repayment) can not exceed the lender’s limitation.

You should use a home loan calculator in order to guess the utmost family rate you could potentially more than likely manage. Otherwise contact a home loan company to obtain a very particular amount.

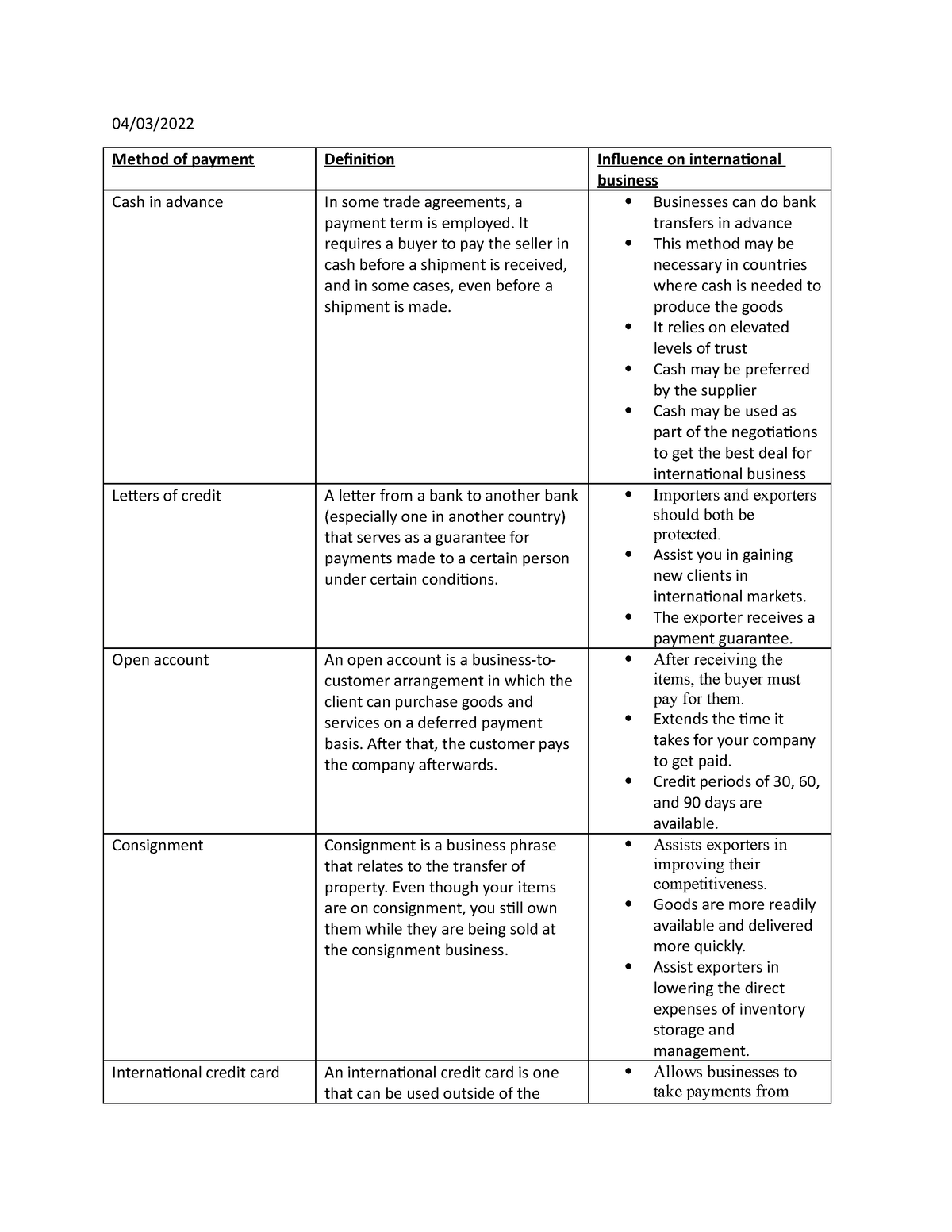

Preciselywhat are FHA loan limitations for 2024?

FHA funds come with their own borrowing limits. Talking about set from the 65% of conforming financing limitation. For instance the Federal Housing Finance Institution, FHA allows for higher limitations with the dos-, 3-, and you may 4-device features, also lengthened limitations in high-prices counties.

- 1-product home: $498,257

- 2-equipment belongings: $637,950

The new FHA program, supported by the newest Federal Property Administration, is supposed having homebuyers which have modest profits and you can fico scores.

Nevertheless FHA as well as serves home buyers inside pricey counties. Single-nearest and dearest FHA mortgage constraints come to $step 1,149,825 for the high priced areas from inside the continental You.S. and you may $1,724,725 into the Alaska, The state, Guam, or even the Virgin Isles.

What exactly are the present traditional financial costs personal loans IN?

Old-fashioned price is closely linked with your credit rating and you will off fee – so if you has a robust economic profile, you can get a below-sector rate of interest.

Score a performance quote to suit your basic otherwise higher-restrict compliant loanpare which to FHA prices, jumbo cost, and you can piggyback financial pricing to be certain you get an informed worth.

However, of several applicants requires money a lot more than their local mortgage restriction. This might wanted another kind of mortgage.