What things to believe whenever applying for a property improve financing

If you’re not confident that it is possible to make the required repayments, it will be best to waiting and you may reevaluate your options.

- When how would you like the job finished? Otherwise need to do brand new advancements instantaneously, it may be really worth prepared and you can rescuing upwards some funds in order to money region, otherwise all, of performs. Wishing before you take out financing could also allows you to replace your credit history and alter your chances of delivering an excellent mortgage with a lower interest.

- Precisely what does the task cost? Make sure you get several quotes for your renovations so you usually do not spend more-the-possibility which means you understand how far you need to acquire. You need to only obtain the quantity you desire and never bring out a bigger loan simply because you are eligible.

- Read the organization you will employ was credible and you will joined to-do the necessary functions. In order to minimise the risk of difficulties subsequently that could wind up charging you much more money, make sure to carefully browse businesses to make sure they’re accredited to do work.

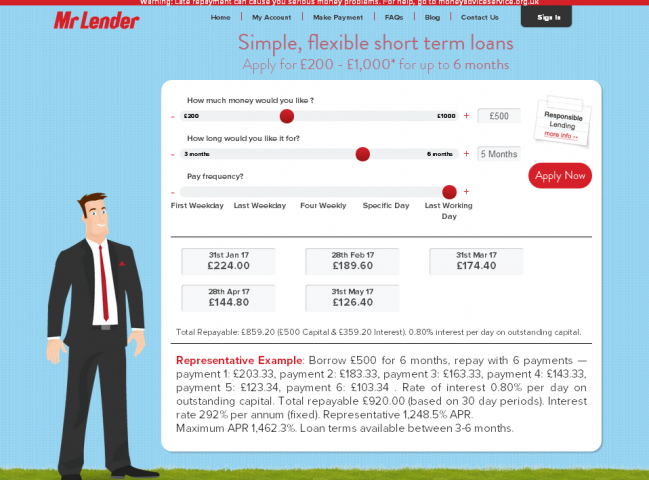

- How much cash is it possible you manage to pay off every month? You will want to work out a budget to see what you are able conveniently be able to repay. This can help you observe how far you could borrow and you can how much time you need to build repayments. However,, brand new lengthened the phrase, the greater amount of you’re likely to shell out during the focus overall.

- Maybe you’ve opposed loan providers? It is best to compare various other loan providers so you can find the best financing for the condition. You may also play with a qualification provider that appears at the several loan providers to see just what finance you could qualify for.

- Have you considered alternatives so you’re able to financing? Taking out fully financing to cover home improvements might only often be the best solution. There are more resources of money that you might envision instead out-of a loan, such a charge card.

- Will you be enhancing your home’s energy savings? Therefore, you will be able to find a loan which have a reduced price or even be eligible for funding from your own opportunity seller or regional council, instance.

Relatives and buddies

For those who have people household members otherwise loved ones that can afford to help you give you some funds, it can be value asking them for a financial loan. However,, although this is a less expensive choice than simply taking out a great authoritative financing, it isn’t a choice that needs to be drawn lightly.

You should know the latest affect the financing could have on your matchmaking and you will exactly what can happen if anything don’t work out. Getting the borrowed funds contract on paper, for instance the terms of installment and you will what happens if you’re unable to pay-off the mortgage, can also be minimise the possibilities of anything heading wrong down the road.

Make sure you only acquire out of someone you know and faith. Be skeptical if someone else gives you that loan while they could getting an unlawful loan-shark.

Playing cards

For individuals who only need to acquire smaller amounts to have an effective very little time, you can consider using credit cards to invest in the necessary performs.

There are many different card issuers providing reasonable otherwise 0% appeal episodes towards requests otherwise balance transfers but keep an eye on the deal end dates once the, if you continue to have outstanding financial obligation in your cards next date, you can end up investing significantly more desire than simply you might to the a standard loan loans Linden AL.

Remortgaging

If you’d like to use a bigger count along with a home loan on your own domestic, you’ll be able to think remortgaging.