Should you Play with A home Collateral Loan To build A swimming pool?

Consumer loan

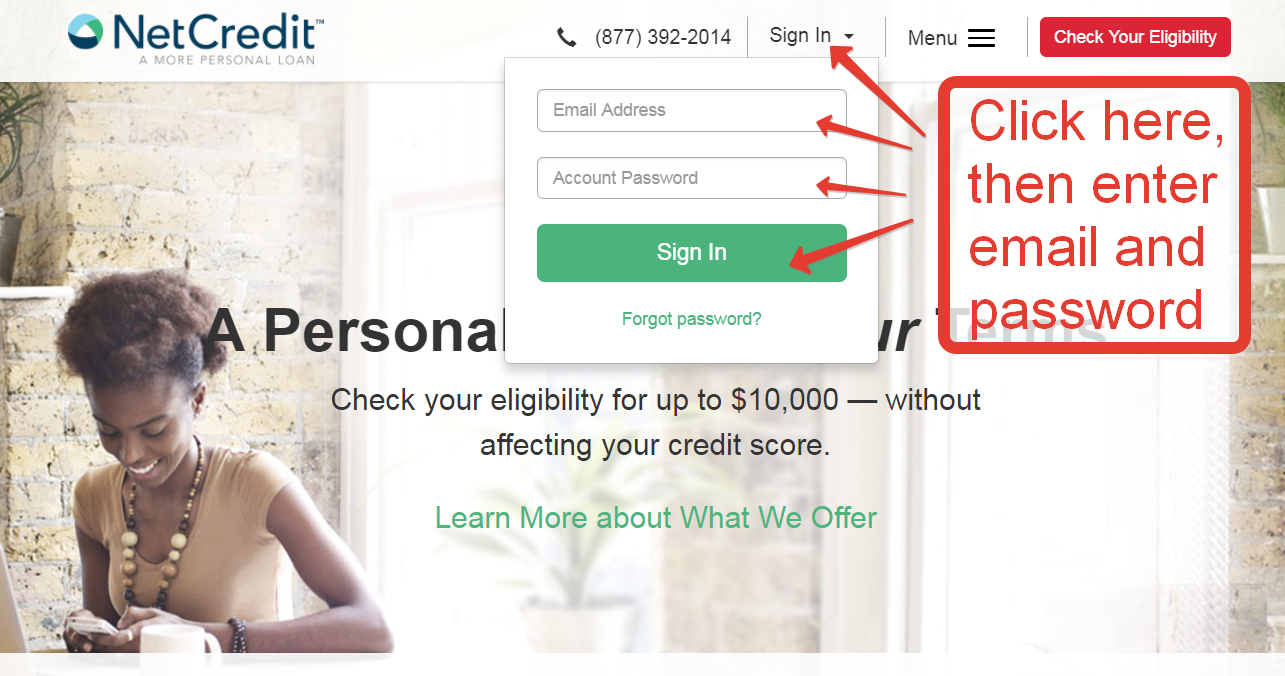

You can get an unsecured loan to finance a share, and those that have good credit can get get the finest pricing. Unsecured loans is actually unsecured repayment fund that allow you to use a single-time lump sum from a lender which you pay-off at the an effective fixed rate of interest. Getting a personal loan, due to the fact most other financing listed here, you will have to show your financial personal personality, proof income, work suggestions, proof house or any other required documents the lender would love observe.

As with most things, financial support a pool with property security loan try a personal choice. Yet not, make sure you are able brand new monthly payments. It is probably one of the most important things to remember when deciding whether or not to have fun with property equity financing having an excellent pool. It is preferable to examine the enough time-name monetary desires including whether or not building a share commonly improve the worth of your house.

Faqs Having Funding A pool With A property Equity Loan

You have got even more questions regarding playing with a property security financing to finance a swimming pool. Why don’t we evaluate a number of which means you get all of the of inquiries.

What’s the repayment months toward property guarantee financing?

The newest repayment period towards the property security financing may differ based your own financial. Most conditions may like it include four to 20 years however you get select a lender who will create a thirty-12 months loan term to blow back property security financing. Skyrocket Home loan allows 10- and you will 20-seasons repaired terms.

What are the debtor standards for property security mortgage?

To get a property security loan, you should meet a particular lowest credit history also earnings, debt-to-earnings ratio (DTI) and you can domestic security conditions and terms.

Brand new lump sum amount you might obtain from your financial would depend to the number of equity you may have of your property given that better as your credit score. It is best so you can strive for good 620 credit score or maybe more along with an effective DTI out-of 45% otherwise lower.

To start with, their bank will try to obtain a feeling of how good your manage personal debt to determine if you’ll qualify for good house security mortgage. DTI refers to the amount of loans you may have in accordance with your revenue. You could estimate your DTI adding enhance repaired month-to-month costs and you can breaking up by your terrible month-to-month income and you can changing they to help you a portion.

Commonly strengthening a swimming pool help the worth of my home?

Strengthening a share may improve house value. An appraiser helps you determine whether or not adding a good swimming pool often impact the fair ple, in the event your house is valued on $3 hundred,000 rather than a pool and you may was value $310,000 having a share, it may not become really worth the rates, particularly if installment costs upward out-of $60,000. It is better to-do extensive research and you can mathematics just before you will be making a final decision in the whether or not to score a house security loan to own a share.

The bottom line

If for example the fantasy should be to fund an enthusiastic aboveground otherwise inground pool, you can remove a house guarantee mortgage or any other loan form of to finance it. Anywhere between a money-aside refinance, HELOC, structure mortgage otherwise unsecured loan, you’ve got specific possibilities for you. Think about your other official certification and how much it will cost monthly to ensure your home on the right choice for the money you owe.

Same as which have a routine home loan, you are going to need to present your credit rating and other files such as for example taxation statements, W-2s and you may financial comments with the financial to help you prove to pay the loan.